Portfolio management - One political catastrophe at a time

The Brexit vote was a real test for our portfolios. We had followed the old adage of ‘hope for the best but plan for the worst’ so, while we were deeply disappointed with the result we were at least confident that our clients’ portfolios were reasonably well protected.

Research, test and then test some more…

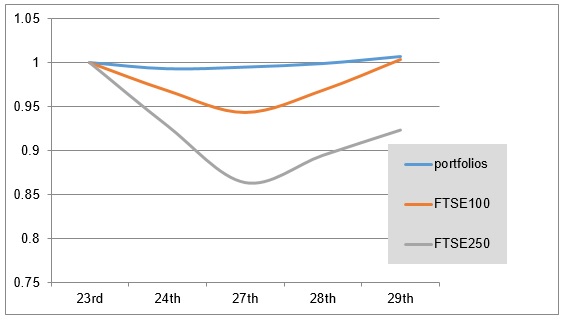

In May we ran some test scenarios to see what the effect of a Brexit vote might be. We tried to model the interactions between different markets, asset types and currencies, working on an assumption that a Brexit vote would lead to a 10% reduction in the value of Sterling and a similar fall in the main stock market. Our somewhat crude model suggested portfolios might be expected to fall around 3% in this extreme example. In the event neither assumption was a million miles out, however the portfolios proved very much more resilient than our modelling predicted. The way we manage money means pretty much everyone’s portfolio is unique but they are all similar. The chart below shows the average return across all portfolios over the five days around the vote – in the event our portfolios in aggregate lost less than 10% of the model prediction and very much less than markets generally. We virtually eliminated volatility over the period. We are acutely aware of the dangers of hubris; we are only just out of the starting gates in terms of this crisis and it has a very long way to run, but I think we can say we’ve had a good start, so far so good.

How did we manage this?

Nothing to do with being clever I’m afraid – in the main it was simply because we took the decision to increase diversification at the start of the year in response to what we perceived were heightened global risks. Although, perhaps we were just a little bit clever. We spent a fair while debating whether we should hedge against the Yen – Japanese funds did incredibly well in the wake of Abe’s stimulus package but a lot of these gains were lost to Sterling investors through currency movements. Following Abe’s re-election and the rekindling of his stimulus policy, Radi carried out a lot of research before concluding we were better not to hedge. This meant that when markets around the world fell sharply the 7% fall in the Japanese market was more than compensated for by the 15% devaluation of the pound against the Yen.

If we’ve not lost money does this mean Brexit is good?

I was struck by a comment leading Brexiteer and Leader of the House Mr Grayling made on Monday 27th June. Asked whether Project Fear was turning into Project Reality, with equity markets around the world in freefall and the pound collapsing he replied that it wasn’t all bad – the price of Government Bonds was rising. That one comment laid bare his ignorance. Government bond prices rise when the yield falls. The yield falls because people have no confidence in the future. That yields have fallen below 1% indicates that a great number of people far cleverer than you, me and certainly, it would appear, Mr Grayling, feel the future outlook is so dire they are prepared to accept a negative real return rather than risk their capital.

Our client’s portfolios have performed well in large part because the pound has collapsed. The FTSE 100, which is dominated by 20 multinational companies, has out-performed the FTSE 250 because the overseas earnings of those multinationals will receive a Sterling boost from the de facto devaluation. Although this is very useful for investors it is important to appreciate the expected increased profits are dependent on the continued perception of the UK as a weakened economy.

A lower pound means our exports will be cheaper – if we can manage to persuade companies like Nissan to stay while we negotiate a new relationship with the EU then that should be helpful. However, it also means imports will be more expensive. Great – it will encourage us to buy more from our own manufacturers and mean they will also be able to export more. Except we import a vast amount more than we export. The current account deficit is £32,600,000,000, around a third of a trillion pounds. It is naïve to think we could reduce this meaningfully overnight. What is more likely to happen is we will import inflation.

But isn’t inflation a good thing? it seems only five minutes ago that we were worried about deflation. There is good inflation, there is bad inflation and there is blimmin’ terrible inflation. This is in the latter category because it is not driven by higher wages, it is not driven by increased profits it is simply a result of a reappraisal of the value of the UK. It means that it will be borne by consumers with little hope of compensatory pay increases and companies with little room to increase their prices. It will lead directly to a squeeze on living standards and profits. We will all be poorer, which means we will buy less of the good and services our native companies are offering which will simply accelerate the downward spiral.

And to the extent the lower pound dissuades us from buying as many imports so this means those exporting to us will be able to buy less from us, even if our goods are now cheaper.

In short, to answer the question…

The relatively benign reaction of the markets is an illusion hidden behind the smokescreen of the fall in the pound. It is not good news.

So where do we go from here?

It’s worth thinking back to the reasons we structured our clients’ portfolios as we did. We considered there were a number of potentially larger than usual global risks. At the time – indeed until last Friday morning – we felt Brexit was unlikely. Our primary concerns centered on the general slowdown and potential reversal of the global recovery, the persistence of low oil prices and the tension between very fragile economies barely out of recession and a US economy that wanted to start the move towards unwinding QE and normalising interest rates. All those risks persist; all that has changed is Brexit has heightened them. We therefore feel our core strategy remains unchanged – we continue to diversify widely and in times of heightened risk we aim for a low volatility. The current beta of our core model portfolio is 0.5, which means it is expected to be half as volatile as the market portfolio.

There have been some changes which have proven not to be advantageous. We reduced exposure to the FTSE100 in favour of the FTSE250. At the time we felt the global risks were higher than domestic risks and reducing exposure to overseas earnings was prudent. Over the referendum this has proven to be a mistake but we are comfortable with maintaining this exposure as providing a degree of diversification against global risks.

An so to the Autumn..

Overall, we feel we have jumped over the first hurdle reasonably safely and are now turning eyes towards the next ones – postponed autumn Brexit decision, autumn US president elections, autumn US Fed interest rate decision – it’s going to be an interesting autumn…

For more information on how we manage our clients’ money, please do not hesitate to contact us on 01603 597700.